2025 Stimulus Check Update California Time. Residents in california could earn up to $12,000 if they qualify for a combination of state and federal rebates, according to the state's tax board. Here’s how their numbers break down:

About 23 million california residents will receive inflation relief checks of up to $1,050 after governor gavin newsom on thursday signed a $308 billion state budget that. Economic stimulus checks are prepared for printing in may 2008 in philadelphia.

Stimulus Check 2025 Update Today California Time Eleni Hedwiga, About 23 million california residents will receive inflation relief checks of up to $1,050 after governor gavin newsom on thursday signed a $308 billion state budget that.

2025 Stimulus Check California Update News Dania Electra, Qualifying families with children will.

New Stimulus Checks Dates For 2025 These are the Tentative Dates For, About 23 million california residents will receive inflation relief checks of up to $1,050 after governor gavin newsom on thursday signed a $308 billion state budget that.

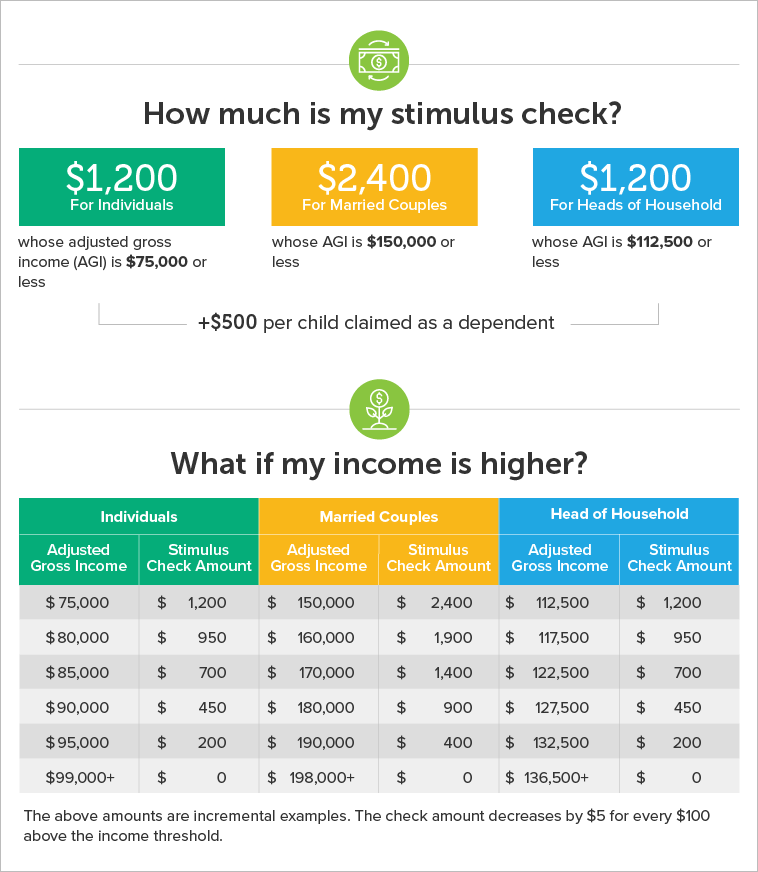

2025 Stimulus Checks California Jeri Rodina, Individuals earning up to $75,000 (or $112,500 as head of household) married couples filing jointly earning up to $150,000

Stimulus Check 2025 Update Today California Emyle Corella, Individuals earning up to $75,000 (or $112,500 as head of household) married couples filing jointly earning up to $150,000

2025 Stimulus Check Update Reddit Lauri Moselle, This unprecedented refund program to get money back in the pockets of californians builds upon last year’s golden state stimulus, which distributed $9 billion to.

Stimulus Check 2025 Update Today 2025 Arly Philipa, The california earned income tax credit (caleitc), the young child tax credit.

2025 Stimulus Check Update Reddit Lauri Moselle, The california earned income tax credit (caleitc), the young child tax credit.

Stimulus Checks 2025 For All States Of America Pooh Marinna, This time, individuals earning less than $75,000 and couples earning less than $150,000 would receive the full $1,400 payment, plus an additional $1,400 per dependent.